New Zealand Rugby announces 2023 Annual Results

- 2397

- Income of $268m continues to track strongly in 2023

- NZR Reserves almost double to $175m

- NZR+ streaming platform launched in time for the RWC23 in France

- $42m invested in community Game Development

Ongoing investment in future commercial initiatives and community rugby, combined with decreased income in a Rugby World Cup year have seen New Zealand Rugby (NZR) post a net statutory loss of $8.9m for the 2023 financial year.

Click here to view New Zealand Rugby’s audited 2023 financial results

NZR CEO Mark Robinson said further work was needed to achieve a sustainable financial model, but 2023 saw momentum grow.

“There is reason to be optimistic about the direction we are heading in key areas. Player numbers rebounded in 2023, up 7 percent to nearly 150,000 registered players, and we saw Sky viewership for DHL Super Rugby Pacific was up across digital streaming and free to air, a trend that’s continued in 2024 with nearly two million New Zealanders tuning in and a final at Eden Park that sold out in hours.

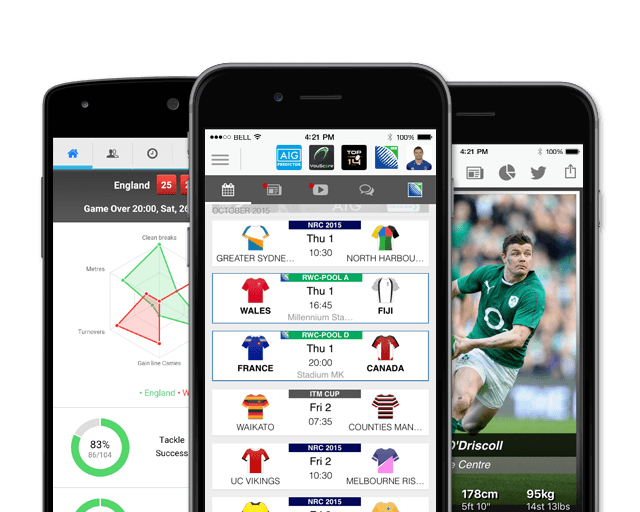

“This sort of positive change was mirrored in the commercial space in 2023 where the full New Zealand Rugby Commercial Board was formed, CEO Craig Fenton was appointed, and in NZRC’s first full year of operation the NZR+ streaming platform was established to engage with our global fanbase. We are seeing some amazing results starting to come through on NZR+ with 33 million unique people engaging with our content since launch.

“At the same time, our commercial income and sponsor support remained at historical highs in 2023, balancing out some of the downside of match day income in a Rugby World Cup year. Our operating result of $8.9m drops to a $5.5m adjusted operating loss when we take into account the related costs of the Silver Lake transaction.”

The overall operating result was heavily impacted by a truncated Lipovitan D Rugby Championship, the lack of the mid-year inbound Steinlager Series, Māori All Blacks or All Blacks XV matches, and just two domestic Tests. The result was a 39 percent decrease in matchday income from $28m to $17m. Broadcast income also decreased by $16 million due to the impact of the 2023 Rugby World Cup.

Balancing that out, sponsorship income of $121m has tracked strongly, up $8m. Sponsorship reflects the strength of NZR’s key commercial brands and the associated sponsorship continued with Altrad, INEOS, and adidas continuing to be key partners.

“The All Blacks went within a whisker of winning the Rugby World Cup in France, and our Sevens teams won their respective World Series titles, and there is much to be optimistic about as we turn our focus to broadcast negotiations, a new players collective agreement, and some exciting future opportunities around international competitions,” Robinson said.

NZR Group Chief Financial Officer Jo Perez said the 2023 financial results reflected the first full year of NZRC in operation and the investment enabled by the Project Future deal with Silver Lake in 2022.

“In 2022 we tagged $38m to use for future commercial initiatives, and in 2023 were able to use $11m of that money to set up the NZR+ streaming platform to tell our stories and reach fans across the world. A total of $120m was also tagged to go into NZR’s Reserves, which increased from $96m to $175m in 2023, a key objective of Project Future.”

Expenditure was down $41m from $318m to $277m, largely due to 2022 expenditure including $37m of distributions to stakeholders from the Project Future deal, however NZR continued to invest to grow the game in 2023 with $42m going toward community Game Development including women's and girl’s rugby.

“We are operating in a challenging, high inflation environment, but it is pleasing to have tightly managed our expenditure, without compromising our ongoing investment in the game. We are seeing momentum build with commercial initiatives and as we build our global audience through NZR+,” Perez said.

“Crucially, we have strengthened our Balance Sheet, which provides both resilience against future shocks, and also enables targeted strategic investment. We have more work to do balancing the books as we move toward a sustainable financial model, while investing in commercial opportunities here and offshore, sustained high performance, and communities.”